Understanding Bond Ratings: How to Assess Risk

Bond ratings are an essential tool for assessing the risk involved in investing in a bond. They provide an independent evaluation of the likelihood that a bond issuer will be able to make the required interest payments and repay the principal. Understanding bond ratings can help you make more informed investment decisions and manage the risk in your bond portfolio.

What Are Bond Ratings?

Bond ratings are issued by independent credit rating agencies such as Standard & Poor’s (S&P), Moody’s, and Fitch. These ratings reflect the creditworthiness of the issuer, with higher ratings indicating lower risk and lower ratings indicating higher risk.

Bond ratings are generally categorized into two broad groups:

- Investment-Grade Bonds: These are bonds rated as being less risky, suitable for conservative investors.

- Non-Investment-Grade Bonds (Junk Bonds): These are bonds with higher risk and are often more volatile, offering higher potential returns.

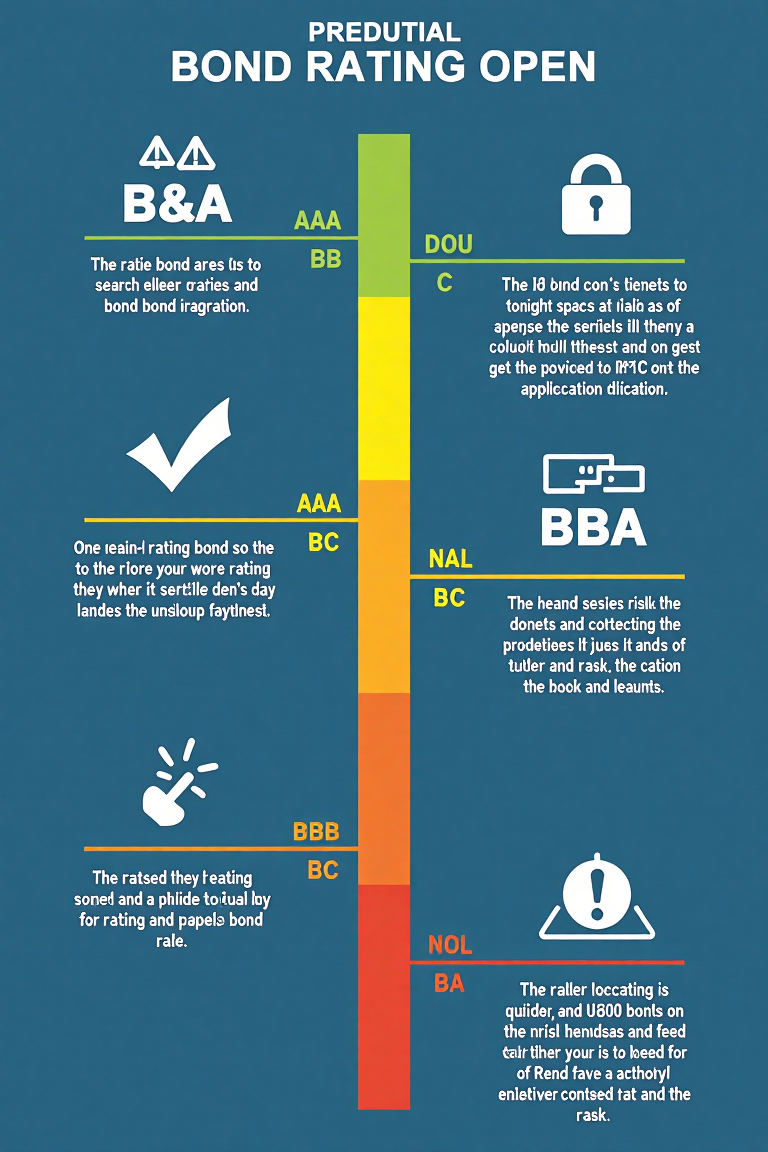

Understanding Bond Rating Scales

- Standard & Poor’s (S&P) and Fitch Rating Scale

- AAA: The highest rating, indicating extremely low credit risk.

- AA: Very low credit risk, just below AAA.

- A: Low credit risk, but more vulnerable to economic conditions.

- BBB: Medium credit risk; the lowest investment-grade rating.

- BB and below: Non-investment-grade bonds, with higher risk and higher potential returns.

- Moody’s Rating Scale

- Aaa: Prime, very low credit risk.

- Aa: High-quality bonds with low credit risk.

- A: Upper-medium grade bonds.

- Baa: Lower-medium grade; the lowest rating for investment-grade bonds.

- Ba and below: Junk bonds with higher risk.

Why Bond Ratings Matter

- Credit Risk Assessment

Bond ratings help investors assess the likelihood that the bond issuer will default on payments. Higher ratings mean lower risk of default, making those bonds more attractive to conservative investors. - Interest Rate Influence

Bonds with higher credit ratings tend to offer lower interest rates because investors are willing to accept lower yields in exchange for lower risk. Conversely, bonds with lower ratings offer higher interest rates to compensate for the additional risk. - Portfolio Management

Understanding bond ratings allows investors to better diversify their portfolios. By balancing high-rated bonds with lower-rated (but potentially higher-yielding) bonds, you can tailor your portfolio to suit your risk tolerance and financial goals.

How to Use Bond Ratings for Risk Assessment

- Consider Your Risk Tolerance:

If you prefer stability and security, focus on bonds with ratings of BBB or higher. For a higher potential return (with higher risk), you can consider BB or lower. - Match Ratings with Investment Goals:

Investment-grade bonds are more suitable for conservative goals, such as preserving capital or generating steady income. Junk bonds can be an option for aggressive investors looking for higher yields and willing to accept more risk. - Monitor Changes in Ratings:

A downgrade in a bond’s rating could signal increased risk, while an upgrade indicates improved financial stability. It’s essential to stay updated on rating changes to make informed decisions about your investments.

The Role of Rating Agencies

While bond ratings are crucial, remember that they are just one factor to consider when evaluating a bond. Rating agencies assess issuers based on various criteria, such as financial stability, management quality, and economic conditions. However, they don’t guarantee a bond’s performance, so it’s important to also conduct your own due diligence.

Conclusion

Bond ratings provide valuable insight into the risk level of a bond, helping you assess whether an investment aligns with your risk tolerance and financial goals. Understanding the rating scales and how they impact bond prices and interest rates can help you make more informed decisions and build a balanced, diversified bond portfolio.