How to Analyze Stocks: Fundamental vs. Technical Analysis

When it comes to investing in stocks, one of the most important skills you can develop is the ability to analyze and evaluate companies. There are two primary methods for analyzing stocks: fundamental analysis and technical analysis. Both approaches offer unique insights into stock performance and can be used in different market conditions. In this post, we’ll explore both types of analysis, how they work, and how you can use them to make better investment decisions.

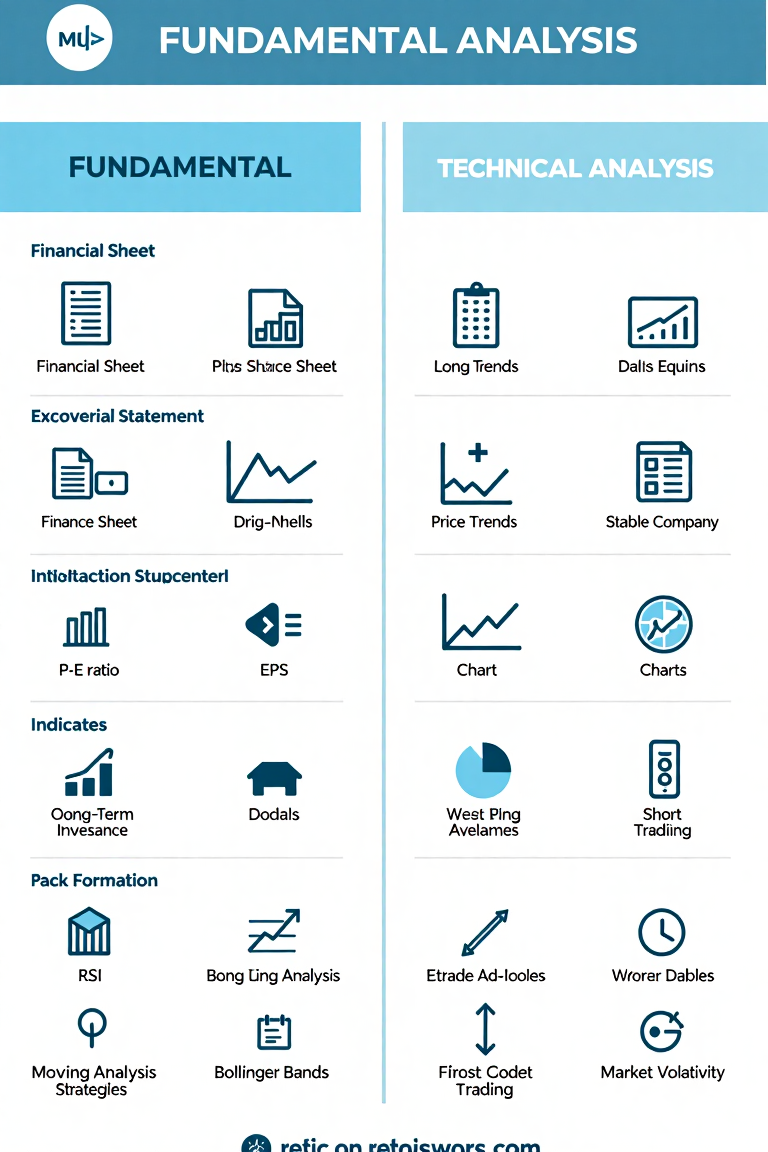

What is Fundamental Analysis?

Fundamental analysis involves evaluating a company’s intrinsic value by examining its financial health, performance, and overall economic environment. This approach focuses on the underlying factors that can influence a company’s stock price, such as:

- Financial Statements: Analysts review the company’s income statement, balance sheet, and cash flow statement to assess profitability, debt levels, and cash flow.

- Earnings and Growth Potential: Understanding the company’s earnings, profit margins, and growth potential helps investors gauge whether the stock is undervalued or overvalued.

- Industry and Economic Factors: Market conditions, industry trends, and the economic environment play a major role in a company’s performance. For example, a strong economy may benefit certain industries, while a recession might hurt others.

Key Metrics in Fundamental Analysis:

- Price-to-Earnings (P/E) Ratio: Helps investors assess whether a stock is overpriced or underpriced relative to its earnings.

- Earnings Per Share (EPS): Measures a company’s profitability by dividing net earnings by the number of outstanding shares.

- Debt-to-Equity Ratio: Indicates the financial leverage of a company by comparing its total debt to shareholders’ equity.

Pros of Fundamental Analysis:

- Focuses on long-term investment strategies.

- Provides insights into the financial health of a company.

- Helps identify undervalued or overvalued stocks.

Cons of Fundamental Analysis:

- Can be time-consuming and complex.

- Less effective in the short term, especially in volatile markets.

What is Technical Analysis?

Technical analysis focuses on the price movements and trading volume of a stock. Unlike fundamental analysis, which looks at the company’s financials, technical analysis is concerned with the patterns and trends of stock prices and how they behave over time. Key components of technical analysis include:

- Charts: Analysts use charts to study past price movements and identify trends (upward, downward, or sideways).

- Indicators and Oscillators: Technical analysts use various mathematical indicators, such as moving averages, Relative Strength Index (RSI), and Bollinger Bands, to help predict future price movements.

- Volume Analysis: The volume of stocks traded can signal the strength of a trend. High trading volumes often indicate strong investor interest.

Key Tools in Technical Analysis:

- Moving Averages: A tool that smooths price data to create a consistent trend line and helps identify the overall market direction.

- Support and Resistance Levels: Identifying levels at which the stock price tends to stop and reverse can help traders make buy or sell decisions.

- Candlestick Patterns: Short-term price movements are often represented using candlestick charts, which can reveal patterns that suggest potential price changes.

Pros of Technical Analysis:

- Provides short-term trading opportunities.

- Effective in volatile markets where prices fluctuate rapidly.

- Helps traders make decisions based on market trends.

Cons of Technical Analysis:

- Can be misleading if used without understanding market fundamentals.

- May not provide long-term investment insights.

Fundamental vs. Technical Analysis: Which Should You Use?

Both types of analysis have their strengths and weaknesses, and many investors choose to use a combination of both to gain a more complete view of the market.

- Fundamental Analysis is best for long-term investors who are focused on a company’s financial stability, growth prospects, and overall market position. It is ideal for identifying stocks that have strong growth potential over time.

- Technical Analysis is ideal for traders who want to capitalize on short-term market fluctuations and identify entry and exit points based on price trends and patterns.

Conclusion

In summary, both fundamental analysis and technical analysis are essential tools in stock market investing. By using fundamental analysis, investors can evaluate the intrinsic value of a company, while technical analysis allows traders to study price movements and trends. Understanding when and how to use both methods can help you make better, more informed investment decisions.