How to Build a Diversified Bond Portfolio

Building a diversified bond portfolio is a key strategy for managing risk and maximizing returns in fixed-income investing. By diversifying your bond holdings, you can reduce exposure to any single asset or risk factor, which helps to stabilize returns over time. In this post, we’ll explore how to construct a diversified bond portfolio, the different types of bonds to consider, and the benefits of diversification.

Why Diversify Your Bond Portfolio?

- Risk Reduction

Diversification is crucial because it spreads the risk across different bond types, issuers, and maturities. When one type of bond is underperforming, others may be performing better, helping to stabilize overall portfolio returns. - Improve Returns

A diversified bond portfolio can offer better returns by capturing a wider range of income sources. This can include government bonds, corporate bonds, municipal bonds, and more. Each type of bond behaves differently in various market conditions, so a balanced portfolio maximizes your opportunity for steady income. - Minimize Interest Rate Risk

Different bonds react to changes in interest rates in different ways. By holding bonds with varying maturities, you can mitigate the impact of interest rate fluctuations. For example, short-term bonds may be less sensitive to rate increases, while long-term bonds may provide higher yields.

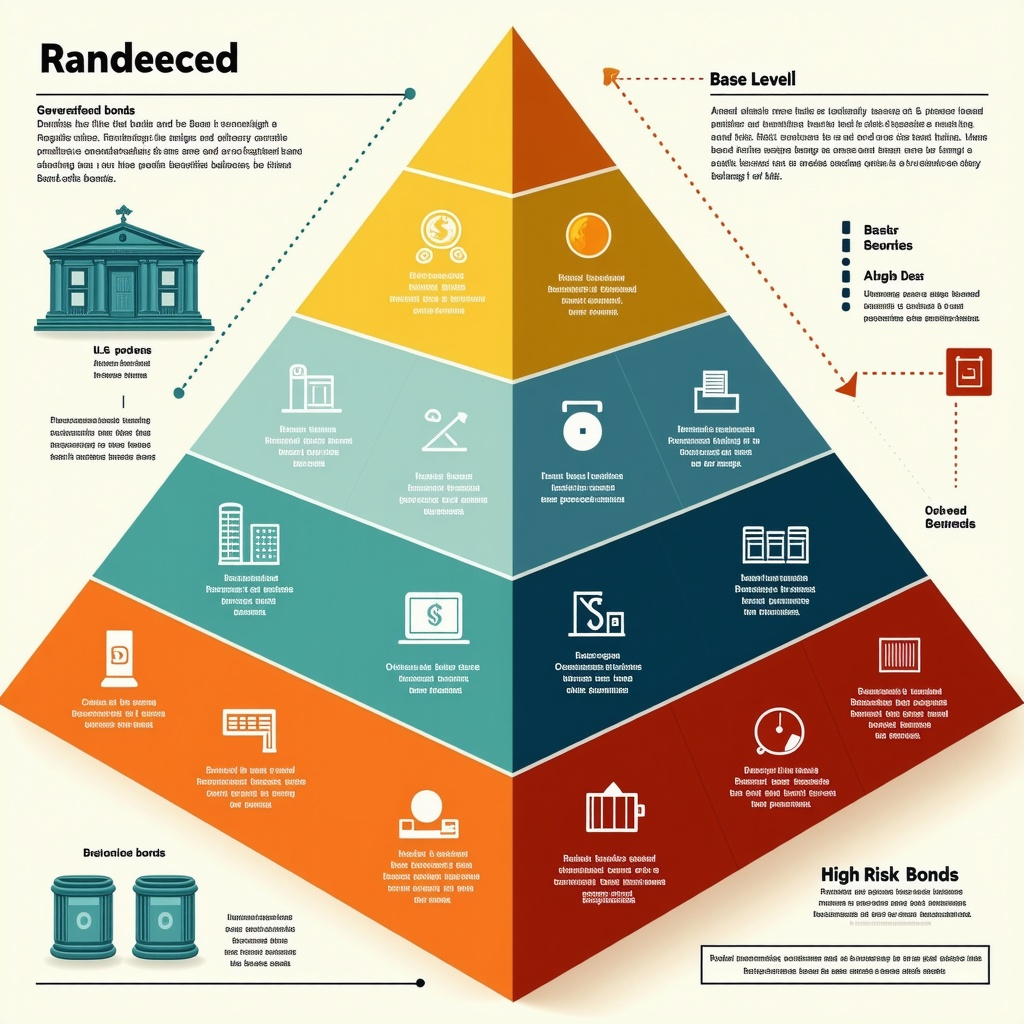

Key Components of a Diversified Bond Portfolio

- Government Bonds

Government bonds, such as U.S. Treasury bonds or other sovereign debt, are the safest part of your bond portfolio. They are backed by the government, making them low-risk investments. They typically offer lower yields but provide stability. - Corporate Bonds

Corporate bonds are issued by companies and offer higher yields compared to government bonds. However, they also carry more risk. Investing in bonds from a range of companies, including those with different credit ratings, can help diversify risk. - Municipal Bonds

Municipal bonds are issued by local governments and are often tax-exempt at the federal level. They tend to have lower yields but can be an excellent choice for tax-sensitive investors. Including municipal bonds in your portfolio can add diversification across sectors and tax benefits. - High-Yield Bonds (Junk Bonds)

These bonds offer higher yields but come with higher risk, as they are issued by companies with lower credit ratings. Including a small portion of high-yield bonds in your portfolio can increase overall returns, but they should be balanced with safer bond types. - International Bonds

Adding international bonds can help diversify your portfolio geographically. International government and corporate bonds can offer exposure to different economies and currencies, reducing your dependence on any single market. - Bond Funds or ETFs

Bond funds and exchange-traded funds (ETFs) are an easy way to gain exposure to a diversified range of bonds. These funds typically invest in a large number of bonds across various sectors, maturities, and credit ratings, offering diversification with a single investment.

Steps to Building a Diversified Bond Portfolio

- Determine Your Investment Goals

Before you start building your portfolio, it’s important to define your investment goals. Are you looking for steady income, long-term growth, or a balance of both? Your goals will determine the types of bonds you include in your portfolio. - Assess Your Risk Tolerance

Consider your risk tolerance and how much risk you are willing to take on. If you are risk-averse, you may want to focus more on government bonds and highly rated corporate bonds. If you’re open to higher risk, you may include more high-yield bonds or corporate bonds with lower credit ratings. - Choose Bonds with Varying Maturities

Bond maturities can significantly affect your returns and risk. Short-term bonds are less sensitive to interest rate changes, but long-term bonds typically offer higher yields. A mix of short-, medium-, and long-term bonds can help you balance risk and return. - Diversify Across Sectors and Credit Ratings

Ensure your portfolio is diversified across different sectors, such as technology, healthcare, finance, and utilities. Also, consider bonds with varying credit ratings—investing in a combination of investment-grade and high-yield bonds can help enhance returns without taking on excessive risk. - Review and Rebalance Your Portfolio Regularly

As market conditions and interest rates change, your bond portfolio may need adjustments. Regularly review your bond holdings and rebalance to ensure that your portfolio continues to align with your investment goals.

Benefits of a Diversified Bond Portfolio

- Stability

A diversified bond portfolio reduces the impact of market volatility, as different bonds will react differently to economic conditions. This provides more stable returns in the long run. - Income Generation

Bonds are a reliable source of income, and by diversifying, you can ensure that you have multiple sources of income from different types of bonds. This can be particularly important for investors seeking consistent cash flow. - Capital Preservation

Bonds generally have lower risk compared to stocks, making them an effective way to preserve capital, especially for conservative investors or those nearing retirement.

Conclusion

Building a diversified bond portfolio is a powerful strategy for managing risk while still generating income. By including a mix of government bonds, corporate bonds, municipal bonds, and other types of debt securities, you can increase the stability and potential returns of your portfolio. Regularly review and rebalance your portfolio to ensure it aligns with your investment goals and risk tolerance.