Understanding Asset Allocation: The Key to Long-Term Success

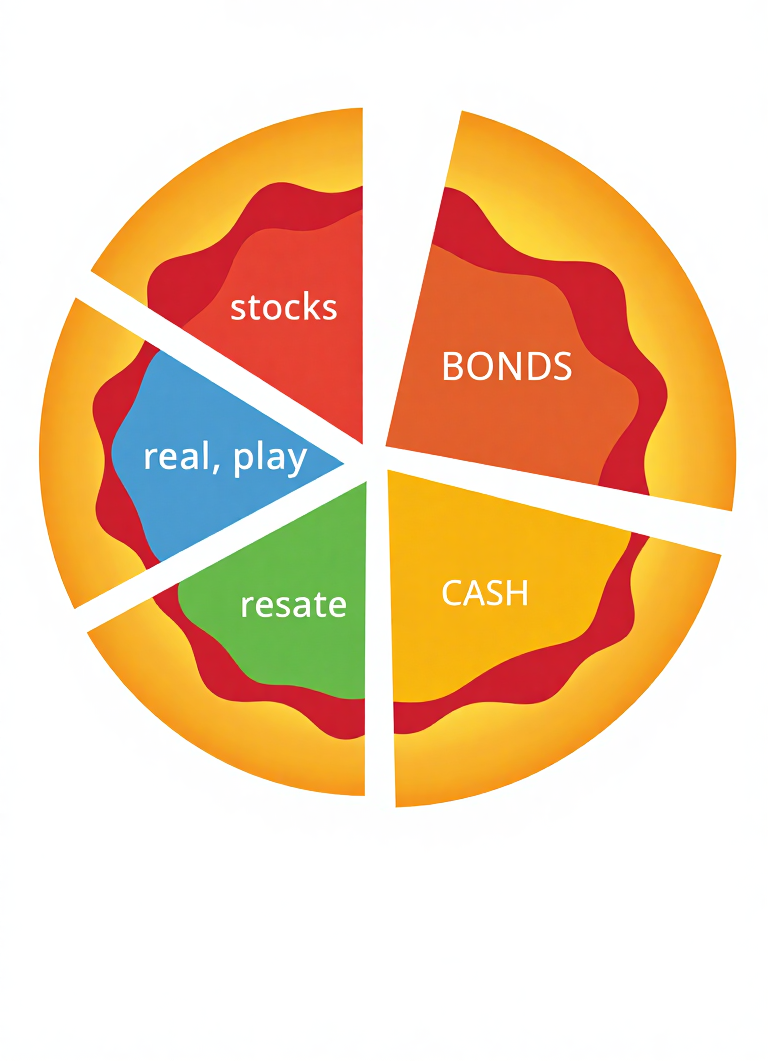

Asset allocation is one of the most important strategies in managing investments and achieving long-term financial goals. It’s the process of dividing your investments across different asset classes—such as stocks, bonds, real estate, and cash—to manage risk and maximize potential returns. In this post, we will explore what asset allocation is, why it’s crucial, and how to create a diversified portfolio for long-term financial success.

What Is Asset Allocation?

At its core, asset allocation refers to how you distribute your investment portfolio across different asset categories. The idea is to balance risk and reward by investing in assets that respond differently to the same market conditions. A well-diversified portfolio can help protect your investments from market volatility and increase your chances of earning a consistent return over time.

The primary asset classes include:

- Stocks (Equities): Representing ownership in a company, stocks have the highest potential for returns but come with higher risk.

- Bonds: Debt securities issued by governments or corporations. They tend to be less volatile than stocks, providing more stability to a portfolio.

- Real Estate: Investment in properties can offer diversification and a hedge against inflation.

- Cash and Cash Equivalents: These include savings accounts and money market funds. They provide liquidity but tend to offer low returns.

Why Is Asset Allocation Important?

The main goal of asset allocation is to optimize your portfolio based on your investment goals, risk tolerance, and time horizon. Here’s why it’s crucial:

- Diversification: By spreading your investments across different asset classes, you reduce the risk of significant losses. When one asset class underperforms, others may perform well, helping to balance out the overall performance of the portfolio.

- Risk Management: Different assets react differently to market conditions. A diversified portfolio helps reduce the impact of market volatility, as each asset class has its own risk-return profile.

- Achieving Financial Goals: By adjusting your allocation based on your specific financial goals—such as saving for retirement, buying a home, or funding education—you can create a strategy that aligns with your needs.

How to Determine the Right Asset Allocation

There is no one-size-fits-all approach to asset allocation. Your ideal allocation will depend on several factors, including:

- Risk Tolerance: How much risk are you willing to take? If you’re comfortable with higher risk, you may allocate more to stocks, which have the potential for greater returns. If you prefer a safer, more conservative approach, you may allocate more to bonds or cash equivalents.

- Time Horizon: How long do you plan to keep your money invested? If you’re investing for retirement in 30 years, you might be able to take on more risk. If you need the money within a few years, a more conservative allocation may be appropriate.

- Financial Goals: Your specific financial objectives should play a role in how you allocate your assets. Long-term growth might lead you to favor equities, while short-term stability might lead you to favor bonds and cash.

- Life Stage: Younger investors typically have a longer time horizon and can afford to take more risks. As you age and get closer to your financial goals, you may want to shift toward a more conservative asset allocation.

The 60/40 Rule

A common rule of thumb for asset allocation is the 60/40 rule. This strategy involves investing 60% in stocks and 40% in bonds. The idea is to balance the higher growth potential of stocks with the stability and income-generating qualities of bonds. While this rule is a good starting point, it’s important to tailor your allocation based on your personal situation.

Rebalancing Your Portfolio

Over time, your asset allocation may drift due to market fluctuations. For example, if stocks perform well, they may comprise a larger portion of your portfolio than you originally intended. Rebalancing involves adjusting your portfolio back to your target allocation to maintain your desired risk level. Most advisors recommend rebalancing annually or whenever your allocation deviates significantly from your target.

Conclusion

Asset allocation is a fundamental strategy for achieving long-term financial success. By carefully selecting the right mix of assets and regularly reviewing your portfolio, you can help manage risk and maximize your investment potential. Whether you’re just starting to invest or are well on your way, understanding asset allocation is crucial for building a strong and sustainable financial future.