Bitcoin vs. Altcoins: Key Differences and Benefits

Bitcoin is the first cryptocurrency, but today there are thousands of different cryptocurrencies, collectively known as altcoins. While Bitcoin continues to dominate the market, altcoins have emerged to offer unique features and benefits. In this post, we’ll explore the key differences between Bitcoin and altcoins and why you might consider investing in each.

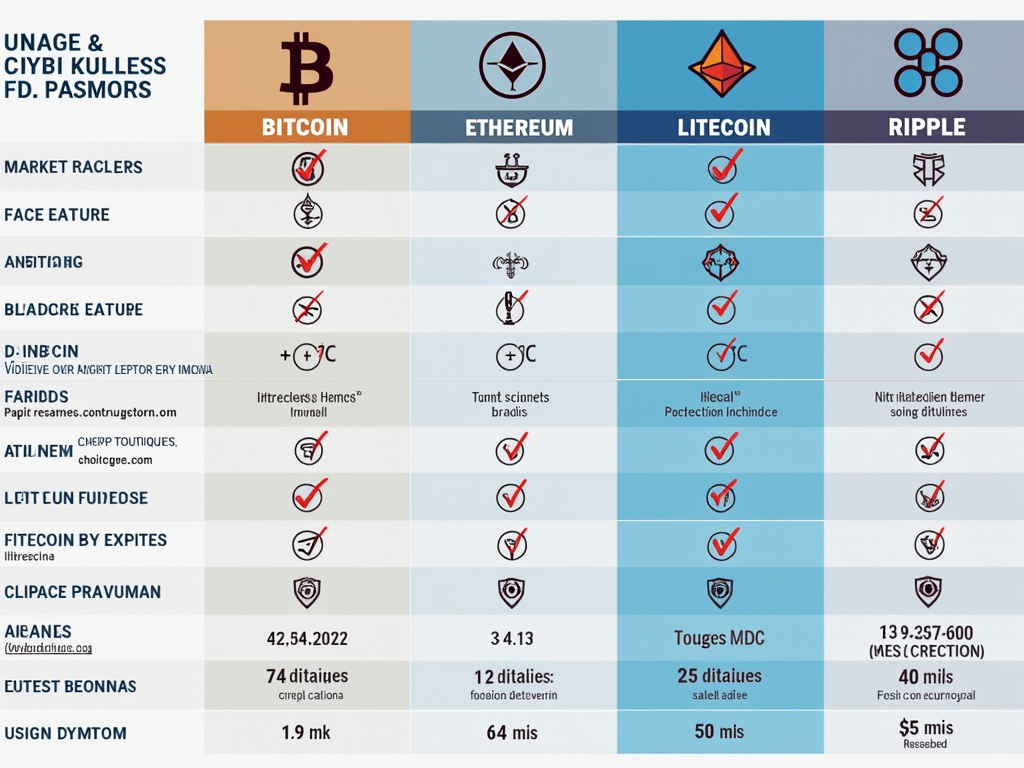

Key Differences Between Bitcoin and Altcoins

- Origin and Purpose

- Bitcoin: Created in 2008 by an anonymous figure known as Satoshi Nakamoto, Bitcoin was designed to be a decentralized digital currency, independent of governments and banks.

- Altcoins: These are any cryptocurrencies that aren’t Bitcoin. Some of the most popular altcoins, like Ethereum, Ripple (XRP), and Litecoin, were created to offer solutions to the limitations Bitcoin faces, such as scalability, speed, and transaction fees.

- Blockchain Technology

- Bitcoin: Bitcoin operates on its own blockchain, known for its security and decentralization, but it can struggle with speed and scalability.

- Altcoins: Many altcoins operate on their own blockchains with innovative features. Ethereum, for instance, supports smart contracts and decentralized applications (dApps), expanding its functionality beyond simple transactions.

- Supply Limits

- Bitcoin: Bitcoin has a fixed supply of 21 million coins, which makes it scarce and potentially more valuable over time.

- Altcoins: Altcoins often have different supply models. For example, Ethereum has no fixed supply, which can impact its value and inflation rate.

- Transaction Speed and Fees

- Bitcoin: Bitcoin transactions can be slower and come with higher fees, especially when the network is congested.

- Altcoins: Some altcoins, like Litecoin and Ripple, offer faster transaction speeds and lower fees, making them more practical for daily use and smaller payments.

- Market Capitalization and Popularity

- Bitcoin: Bitcoin holds the largest market capitalization and remains the most well-known and widely adopted cryptocurrency.

- Altcoins: While Bitcoin leads, certain altcoins have experienced significant growth and have developed niche uses, such as Ethereum for smart contracts, or Cardano for its proof-of-stake consensus.

Benefits of Investing in Bitcoin and Altcoins

- Bitcoin

- Store of Value: Often referred to as “digital gold,” Bitcoin has been seen by many as a safe haven for long-term investors.

- Network Effects: Bitcoin has the largest and most secure network, with widespread adoption and institutional interest.

- Liquidity: Bitcoin offers high liquidity, meaning you can easily buy or sell it on most exchanges.

- Altcoins

- Innovative Features: Altcoins like Ethereum and Polkadot bring forward technological advances that Bitcoin doesn’t offer, such as smart contracts, decentralized finance (DeFi), and faster transactions.

- Diversification: With a wide range of altcoins available, investors can diversify their portfolio, which may reduce risk and increase potential for profit.

- Lower Entry Price: Many altcoins are priced much lower than Bitcoin, making them more accessible for new investors.

Conclusion

Bitcoin remains the leader in the cryptocurrency space, but altcoins offer exciting opportunities for those looking to diversify or explore the future of blockchain technology. By understanding the key differences and benefits, you can make informed decisions about which cryptocurrencies best suit your investment goals.