-

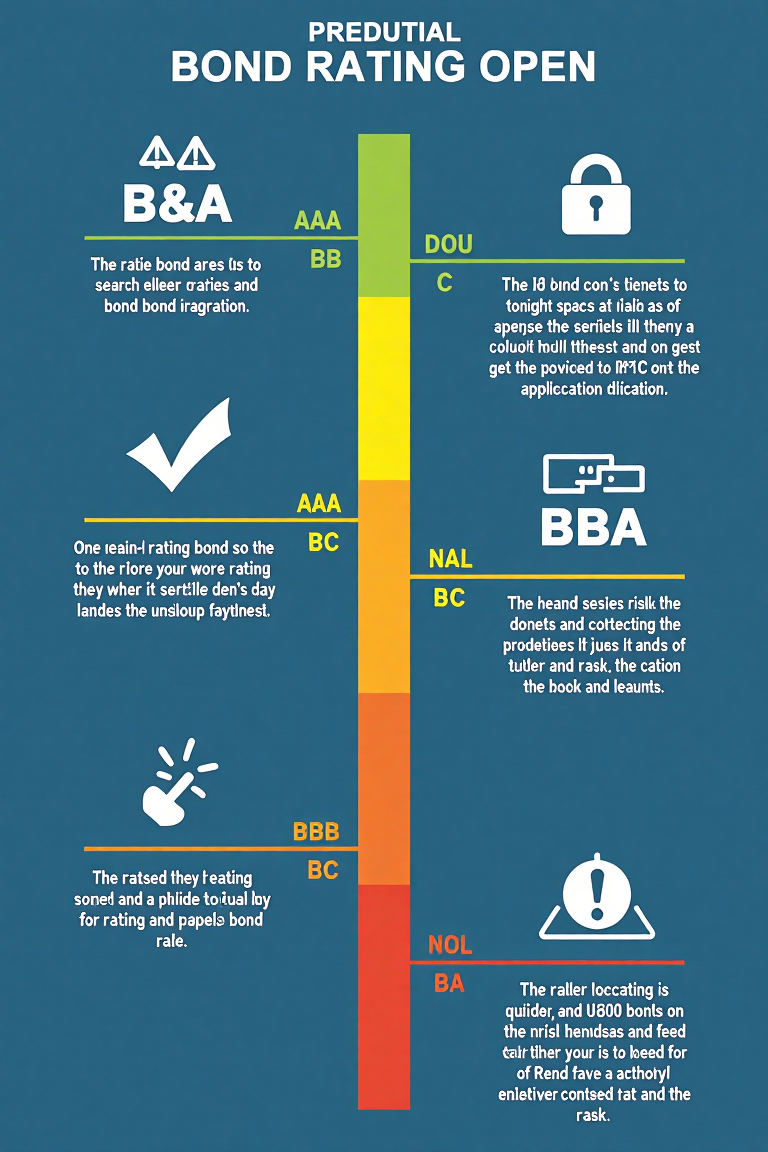

Understanding Bond Ratings: How to Assess Risk

Understanding Bond Ratings: How to Assess Risk Bond ratings are an essential tool for assessing the risk involved in investing in a bond. They provide an independent evaluation of the likelihood that a bond issuer will be able to make the required interest payments and repay the principal. Understanding bond ratings can help you make…

-

The Risks and Rewards of Investing in Bonds

The Risks and Rewards of Investing in Bonds Bonds are often considered a safer investment compared to stocks, offering consistent returns and lower volatility. However, like any investment, they come with their own set of risks and rewards. Understanding these can help you make informed decisions and manage your portfolio effectively. The Rewards of Investing…

-

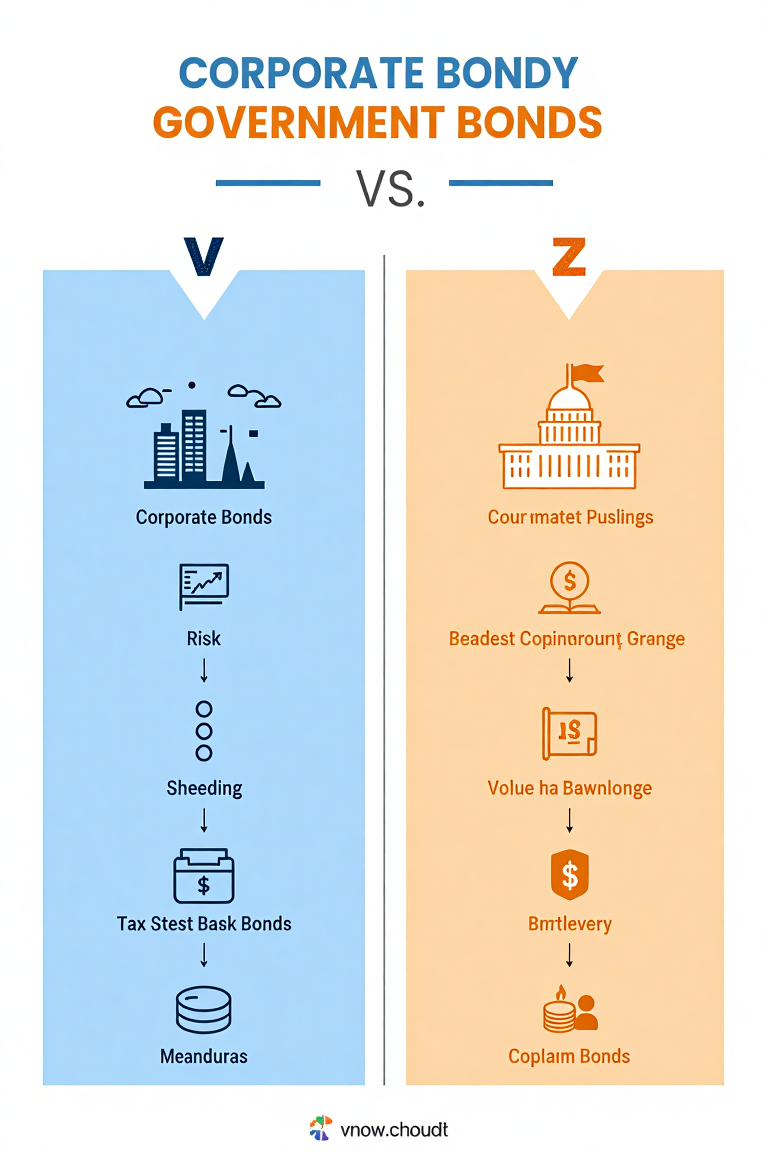

Corporate Bonds vs. Government Bonds: Key Differences and Benefits

Corporate Bonds vs. Government Bonds: Key Differences and Benefits When it comes to investing in bonds, choosing between corporate bonds and government bonds can be a crucial decision. Each type offers unique benefits and risks that cater to different financial goals and risk appetites. This guide will help you understand the key distinctions between these…

-

What Are Bonds? A Beginner’s Guide to Debt Investments

What Are Bonds? A Beginner’s Guide to Debt Investments Bonds are one of the most widely used investment vehicles, offering a reliable way to earn income and preserve capital. Whether you’re new to investing or looking to diversify your portfolio, understanding bonds is essential. This guide will break down what bonds are, how they work,…

-

The Future of Pension Funds: Digitalization and Sustainability

The Future of Pension Funds: Digitalization and Sustainability As the world rapidly evolves, so too do the strategies and tools used to manage pension funds. The future of pensions is increasingly shaped by two major forces: digitalization and sustainability. These trends not only promise to transform the way pension funds are managed but also offer…

-

The Risks of Inflation on Pension Funds and How to Protect Yourself

The Risks of Inflation on Pension Funds and How to Protect Yourself Inflation poses a significant risk to pension funds, as it reduces the purchasing power of money over time. For retirees relying on fixed income from their pension, inflation can erode the value of their savings and jeopardize financial stability. Understanding the risks and…

-

How Are Pension Savings Taxed and How to Minimize Taxes

How Are Pension Savings Taxed and How to Minimize Taxes Taxation plays a significant role in determining how much of your pension savings you’ll actually get to enjoy during retirement. Understanding how pension savings are taxed and exploring strategies to minimize taxes can help you maximize your retirement income. Here’s a guide to navigating the…

-

The Role of Investments in Growing Pension Savings

The Role of Investments in Growing Pension Savings Investing plays a crucial role in growing pension savings and ensuring financial security in retirement. While regular contributions are essential, the growth of these funds largely depends on how effectively they are invested. Here’s a closer look at why investments matter and how they contribute to the…

-

Fees and Commissions in Pension Funds: What You Need to Know

Fees and Commissions in Pension Funds: What You Need to Know When you invest in a pension fund, you expect to grow your savings over time and secure a comfortable retirement. However, what many investors don’t realize is that pension funds come with various fees and commissions that can significantly impact your returns. Understanding these…

-

Top 10 Strategies for Maximizing Pension Fund Savings

Top 10 Strategies for Maximizing Pension Fund Savings Building a robust pension fund is essential for securing a comfortable retirement. To maximize the value of your pension savings over time, it’s important to use effective strategies that ensure growth, minimize losses, and make the most out of your contributions. Here are some top strategies to…