-

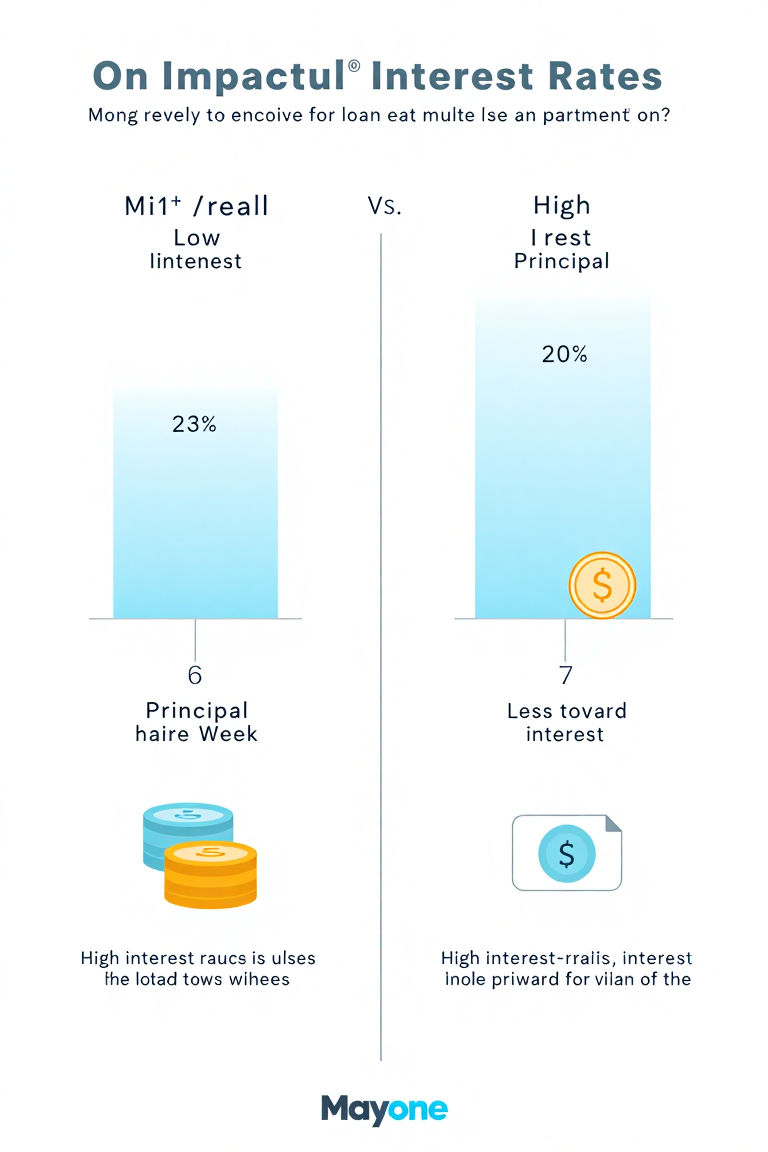

How Interest Rates Affect Loan Repayments

How Interest Rates Affect Loan Repayments Interest rates are one of the most crucial factors to consider when taking out a loan. They determine the cost of borrowing and directly impact the amount you repay over time. Understanding how interest rates work can help you make informed decisions and avoid financial strain. Fixed vs. Variable…

-

The Pros and Cons of Personal Loans

The Pros and Cons of Personal Loans Personal loans are a popular financing option for a variety of needs, from consolidating debt to covering unexpected expenses. While they can be a valuable tool in managing your finances, they also come with potential downsides. Here’s a closer look at the advantages and disadvantages to help you…

-

How to Qualify for a Loan: Key Requirements and Considerations

How to Qualify for a Loan: Key Requirements and Considerations Qualifying for a loan can seem complex, but understanding the key requirements can help you navigate the process with confidence. Here’s what you need to know: 1. Understand Your Credit Score Your credit score plays a critical role in determining your eligibility for a loan.…

-

Types of Loans: Secured vs. Unsecured Loans

Types of Loans: Secured vs. Unsecured Loans When you’re looking for a loan, you might come across different options, but the two most common types are secured and unsecured loans. While both types of loans can help you finance various needs, the difference between them is significant. In this post, we’ll explore the key differences…

-

The Future of Insurance: Technology and Customization

The Future of Insurance: Technology and Customization The insurance industry is rapidly evolving, driven by advancements in technology and an increasing demand for more personalized, flexible solutions. As technology continues to reshape various sectors, the insurance industry is not left behind. In this post, we’ll explore how technology and customization are shaping the future of…

-

How to Save Money on Your Insurance Premiums

10 Ways to Save Money on Your Insurance Premiums Insurance premiums can take up a significant portion of your monthly or yearly budget. Whether it’s auto, home, life, or health insurance, finding ways to save money without sacrificing coverage is key. In this post, we’ll explore several strategies to help you lower your insurance premiums…

-

Top 10 Insurance Myths: Debunking Misconceptions

Top 10 Insurance Myths: Debunking Misconceptions Insurance is a crucial part of financial planning, but many people still hold misconceptions that can lead to costly mistakes. Whether it’s about health, life, auto, or home insurance, myths often prevent individuals from making informed decisions. In this post, we’ll debunk some of the most common insurance myths…

-

Travel Insurance Explained: What It Covers and When You Need It

Travel Insurance Explained: What It Covers and When You Need It Travel insurance is designed to protect you from unforeseen events that may disrupt your trip, whether it’s a medical emergency, trip cancellation, or lost baggage. Understanding what travel insurance covers and when you need it can ensure that you’re prepared for the unexpected. Here’s…

-

The Role of Homeowners Insurance in Protecting Your Assets

The Role of Homeowners Insurance in Protecting Your Assets Homeowners insurance is essential for safeguarding your home and personal property from unexpected events such as fires, theft, vandalism, and natural disasters. It not only protects your physical assets but also provides liability coverage in case of accidents. Here’s why homeowners insurance is crucial and how…

-

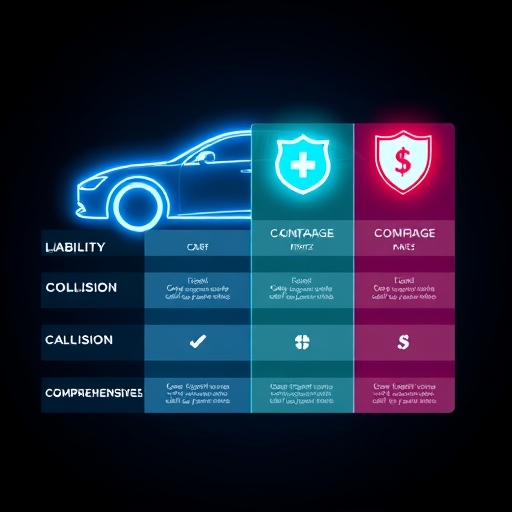

How to Choose the Right Car Insurance Policy

How to Choose the Right Car Insurance Policy Choosing the right car insurance policy is essential for your financial protection and peace of mind. The right coverage can save you from significant expenses in case of accidents, theft, or other incidents. Here are key steps to help you make an informed decision: 1. Assess Your…