-

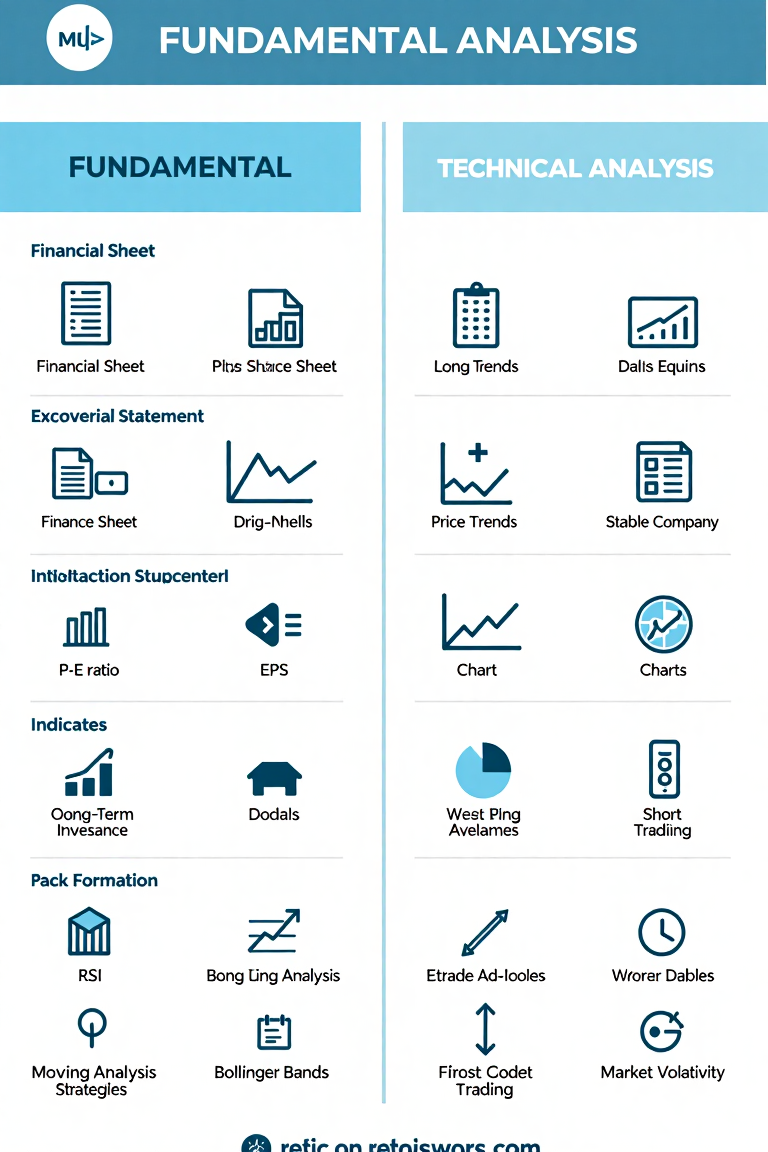

How to Analyze Stocks: Fundamental vs. Technical Analysis

How to Analyze Stocks: Fundamental vs. Technical Analysis When it comes to investing in stocks, one of the most important skills you can develop is the ability to analyze and evaluate companies. There are two primary methods for analyzing stocks: fundamental analysis and technical analysis. Both approaches offer unique insights into stock performance and can…

-

Types of Stock Orders: Market Orders vs. Limit Orders

Types of Stock Orders: Market Orders vs. Limit Orders When you start trading stocks, one of the first decisions you’ll make is choosing how to place your orders. Understanding the different types of stock orders is crucial to managing your investment strategy. In this post, we’ll explore the two most common types of stock orders:…

-

How Stock Trading Works: A Step-by-Step Guide

How Stock Trading Works: A Step-by-Step Guide Stock trading may seem complex at first, but once you understand the process, it becomes a manageable and rewarding way to invest. This guide will walk you through each step involved in trading stocks, helping you gain confidence and take control of your investment strategy. Step 1: Understand…

-

Understanding the Stock Market: Basics for Beginners

Understanding the Stock Market: Basics for Beginners The stock market can seem intimidating at first, but it’s a vital part of the financial world that offers great opportunities for investors. Whether you’re just starting or considering investing for the first time, understanding the basics will help you make informed decisions. What is the Stock Market?…

-

Common Mistakes in Asset Management and How to Avoid Them

Common Mistakes in Asset Management and How to Avoid Them Asset management is a crucial component of long-term financial planning. Whether you’re managing your own portfolio or working with a financial advisor, making informed decisions is essential for building and preserving wealth. However, even the most experienced investors can fall victim to common mistakes that…

-

Ethical Investing: How Advisors Help You Align Your Values with Your Portfolio

Ethical Investing: How Advisors Help You Align Your Values with Your Portfolio In today’s world, more investors are looking to make their money work for them, not just financially, but also in ways that align with their personal values. Ethical investing, also known as socially responsible or sustainable investing, focuses on making investment decisions based…

-

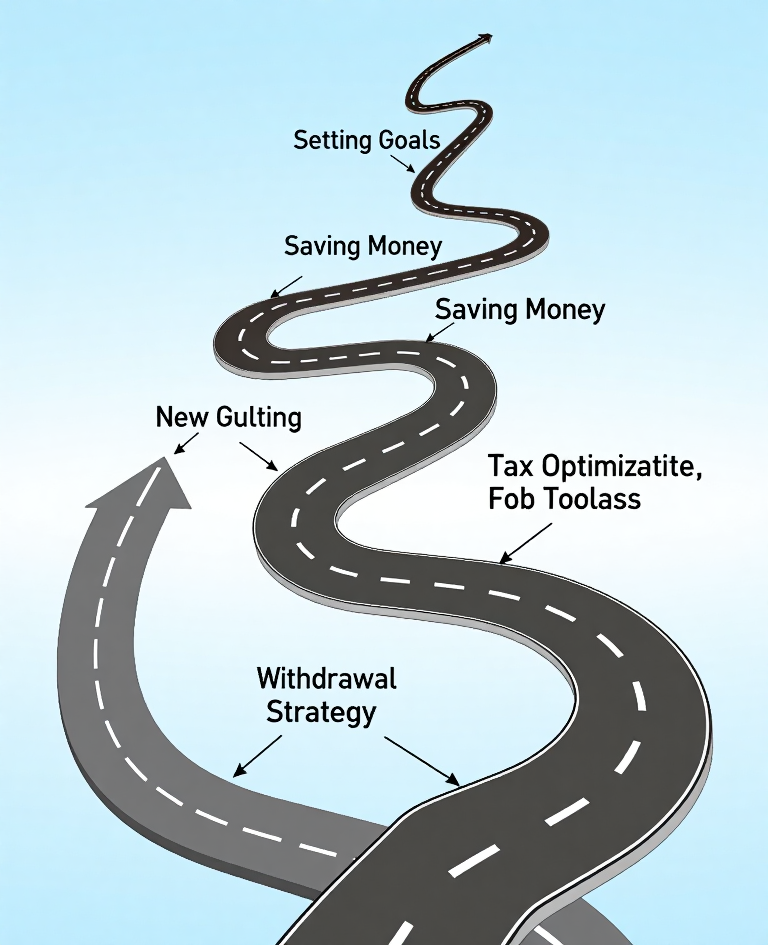

The Role of Financial Planning in Retirement Readiness

The Role of Financial Planning in Retirement Readiness Retirement is a phase of life that many look forward to, but without proper planning, it can become a time of financial uncertainty. Financial planning plays a crucial role in ensuring that you are ready for retirement, not just financially, but also emotionally and practically. Whether you…

-

Tax-Efficient Investing: How Financial Advisors Maximize Your Wealth

Tax-Efficient Investing: How Financial Advisors Maximize Your Wealth Tax efficiency is a crucial aspect of long-term wealth building. While making smart investment decisions is important, minimizing taxes on your investment returns can have a significant impact on your overall financial growth. This is where financial advisors play a pivotal role. They can help you optimize…

-

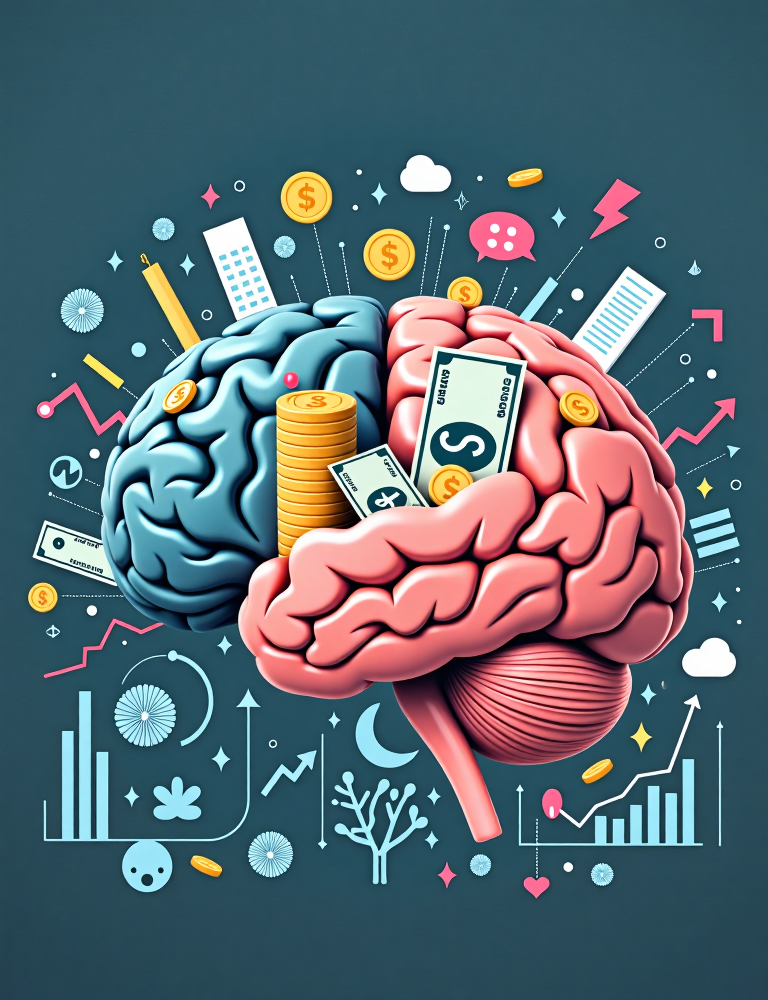

The Psychology of Money: How Financial Advisors Help You Stay Rational

The Psychology of Money: How Financial Advisors Help You Stay Rational Managing money can be an emotional rollercoaster, with highs and lows often shaped by our fears, desires, and biases. Understanding how emotions influence financial decisions is key to long-term financial success. Financial advisors not only provide expertise in investments but also help clients navigate…

-

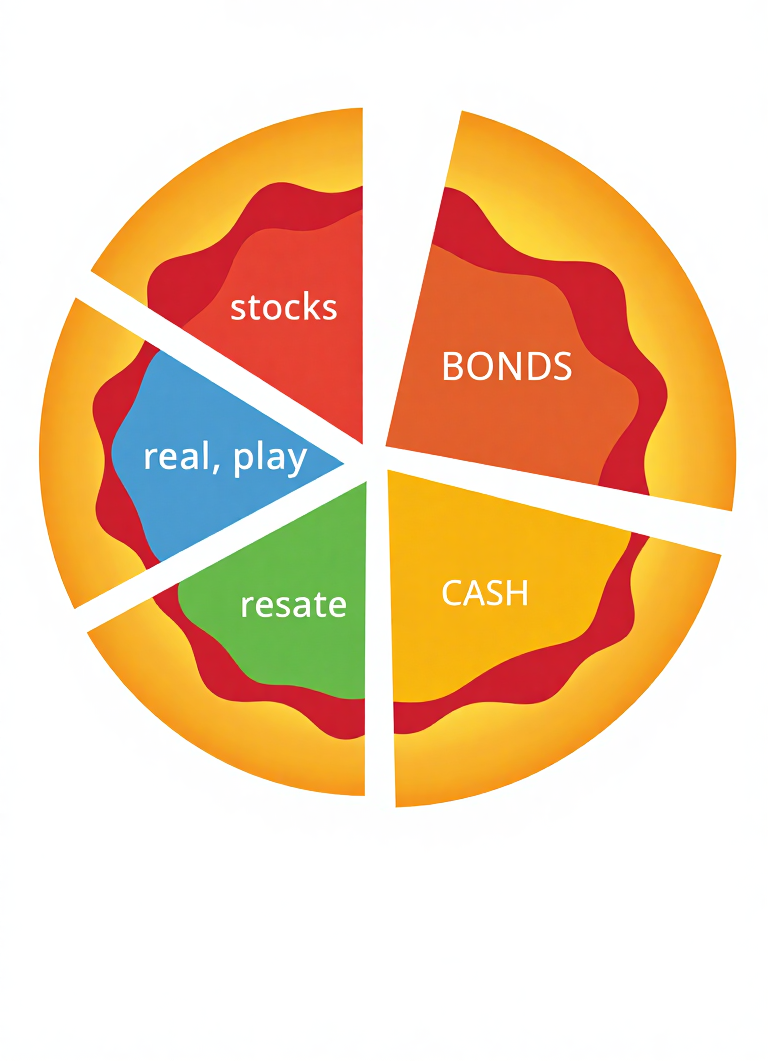

Understanding Asset Allocation: The Key to Long-Term Success

Understanding Asset Allocation: The Key to Long-Term Success Asset allocation is one of the most important strategies in managing investments and achieving long-term financial goals. It’s the process of dividing your investments across different asset classes—such as stocks, bonds, real estate, and cash—to manage risk and maximize potential returns. In this post, we will explore…