-

Green Bonds: Investing in a Sustainable Future

Green Bonds: Investing in a Sustainable Future In a world increasingly focused on sustainability, green bonds have emerged as an innovative way to align investment goals with environmental impact. These unique financial instruments offer investors the opportunity to fund eco-friendly projects while earning returns. In this post, we’ll explore what green bonds are, their benefits,…

-

The Role of Bonds in Retirement Planning

The Role of Bonds in Retirement Planning When planning for retirement, it’s essential to build a portfolio that can provide steady income and preserve capital. Bonds play a crucial role in achieving these goals. Unlike stocks, which can offer higher returns but come with increased risk, bonds are generally seen as a more stable investment.…

-

Tax Implications of Investing in Bonds

Tax Implications of Investing in Bonds Investing in bonds can be a smart strategy to generate steady income and preserve capital, but it also comes with important tax considerations. Bond income, such as interest payments, can be subject to various taxes depending on the type of bond, the investor’s tax bracket, and the country or…

-

What Are High-Yield Bonds? Opportunities and Risks

What Are High-Yield Bonds? Opportunities and Risks High-yield bonds, often referred to as junk bonds, are fixed-income securities that offer higher interest rates (yields) than more secure bonds, such as government or investment-grade corporate bonds. While they can be an attractive investment for those seeking higher returns, high-yield bonds come with a greater level of…

-

How to Build a Diversified Bond Portfolio

How to Build a Diversified Bond Portfolio Building a diversified bond portfolio is a key strategy for managing risk and maximizing returns in fixed-income investing. By diversifying your bond holdings, you can reduce exposure to any single asset or risk factor, which helps to stabilize returns over time. In this post, we’ll explore how to…

-

Treasury Bonds Explained: A Safe Haven for Investors

Treasury Bonds Explained: A Safe Haven for Investors Treasury bonds, often referred to as T-bonds, are one of the safest investment options available. Issued by the government, these long-term debt securities offer a reliable source of income for investors seeking stability. Understanding treasury bonds, how they work, and why they are considered a safe haven…

-

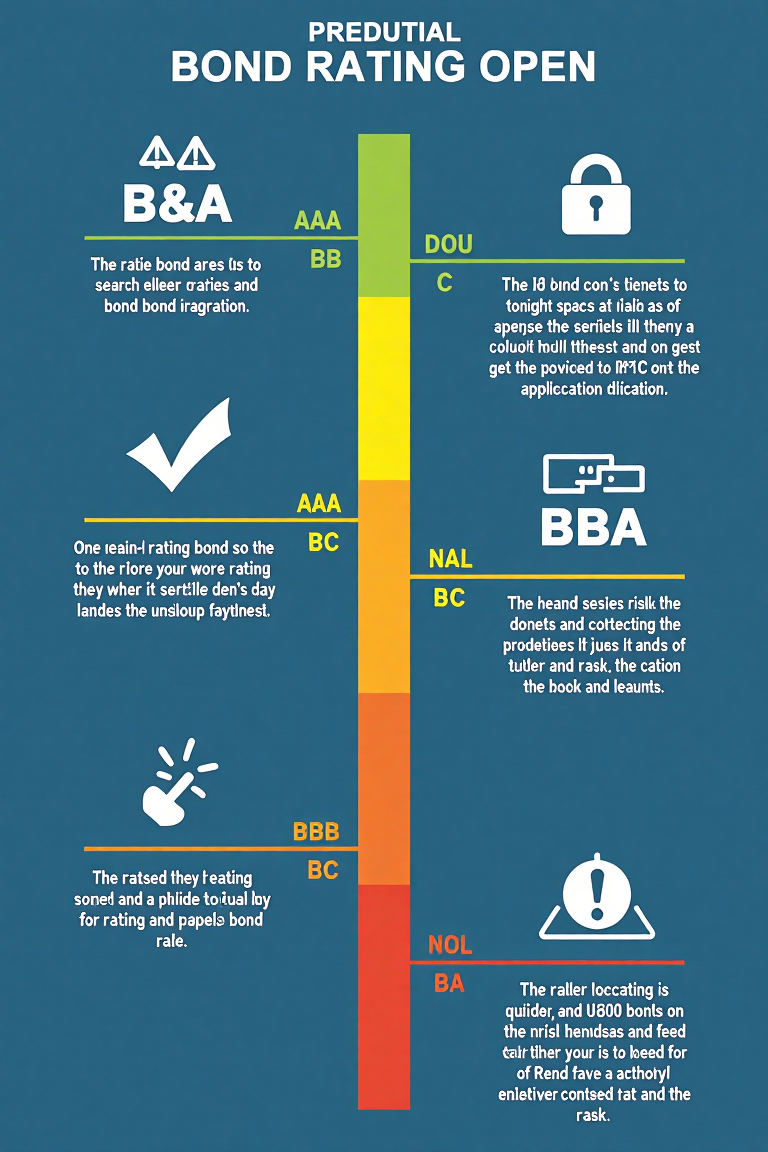

Understanding Bond Ratings: How to Assess Risk

Understanding Bond Ratings: How to Assess Risk Bond ratings are an essential tool for assessing the risk involved in investing in a bond. They provide an independent evaluation of the likelihood that a bond issuer will be able to make the required interest payments and repay the principal. Understanding bond ratings can help you make…

-

The Risks and Rewards of Investing in Bonds

The Risks and Rewards of Investing in Bonds Bonds are often considered a safer investment compared to stocks, offering consistent returns and lower volatility. However, like any investment, they come with their own set of risks and rewards. Understanding these can help you make informed decisions and manage your portfolio effectively. The Rewards of Investing…

-

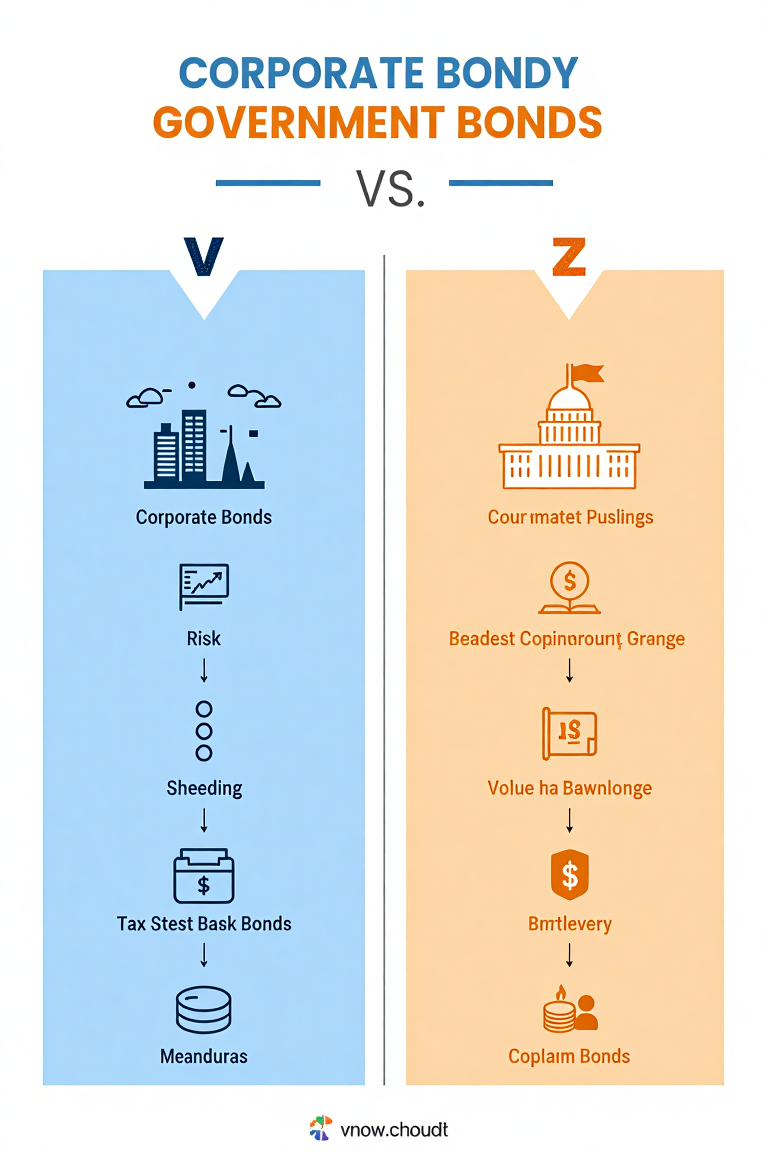

Corporate Bonds vs. Government Bonds: Key Differences and Benefits

Corporate Bonds vs. Government Bonds: Key Differences and Benefits When it comes to investing in bonds, choosing between corporate bonds and government bonds can be a crucial decision. Each type offers unique benefits and risks that cater to different financial goals and risk appetites. This guide will help you understand the key distinctions between these…

-

What Are Bonds? A Beginner’s Guide to Debt Investments

What Are Bonds? A Beginner’s Guide to Debt Investments Bonds are one of the most widely used investment vehicles, offering a reliable way to earn income and preserve capital. Whether you’re new to investing or looking to diversify your portfolio, understanding bonds is essential. This guide will break down what bonds are, how they work,…