-

Refinancing Your Loan: When and Why You Should Consider It

Refinancing Your Loan: When and Why You Should Consider It Refinancing a loan means replacing an existing loan with a new one, typically to obtain better terms. It’s a strategy that can benefit individuals and businesses alike, providing an opportunity to reduce monthly payments, lower interest rates, or adjust the loan term to better align…

-

What Is a Loan and How Does It Work?

What Is a Loan and How Does It Work? A loan is a financial agreement in which one party (the lender) provides money, property, or resources to another party (the borrower) with the expectation that the borrower will repay the loan amount, usually with interest, over an agreed-upon period. Loans are used for a variety…

-

How to Avoid Debt Traps: Managing Loan Repayments Effectively

How to Avoid Debt Traps: Managing Loan Repayments Effectively Getting into debt can happen to anyone, but managing it wisely is what can set you on a path to financial stability. One of the most challenging aspects of borrowing is avoiding what’s known as a “debt trap” — a situation where loans accumulate, interest compounds,…

-

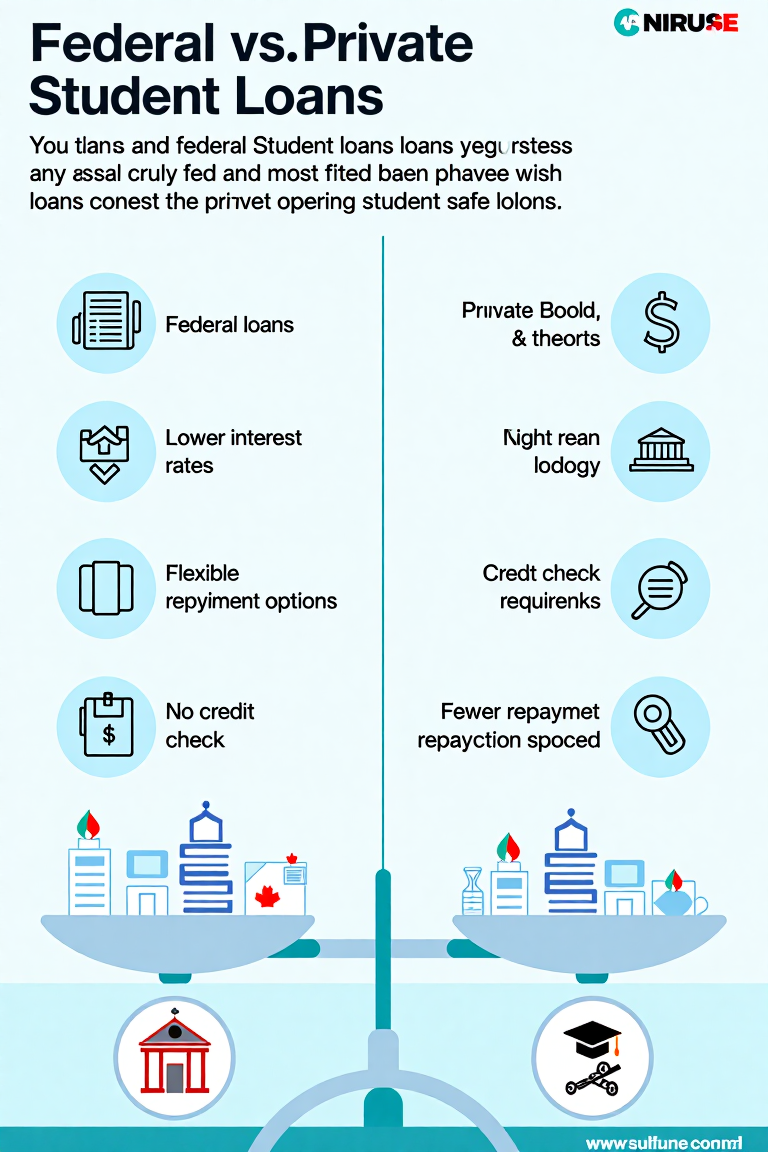

Student Loans: What You Need to Know Before Borrowing

Student Loans: What You Need to Know Before Borrowing Student loans can be a vital tool for funding your education, but understanding the details before borrowing is crucial to avoid financial pitfalls later on. Whether you’re a high school graduate heading to college or a graduate student pursuing advanced degrees, here’s what you need to…

-

Understanding Credit Scores and Their Impact on Loans

Understanding Credit Scores and Their Impact on Loans When you apply for a loan, your credit score plays a crucial role in determining whether you are approved and what terms you are offered. But what exactly is a credit score, and how does it impact your loan application? In this post, we will explain credit…

-

What Is a Mortgage and How Does It Work?

What Is a Mortgage and How Does It Work? A mortgage is a financial tool that allows individuals to purchase real estate, often a home, without paying the full price upfront. This long-term loan is secured by the property itself, meaning the lender can take ownership if the borrower fails to make payments. Mortgages are…

-

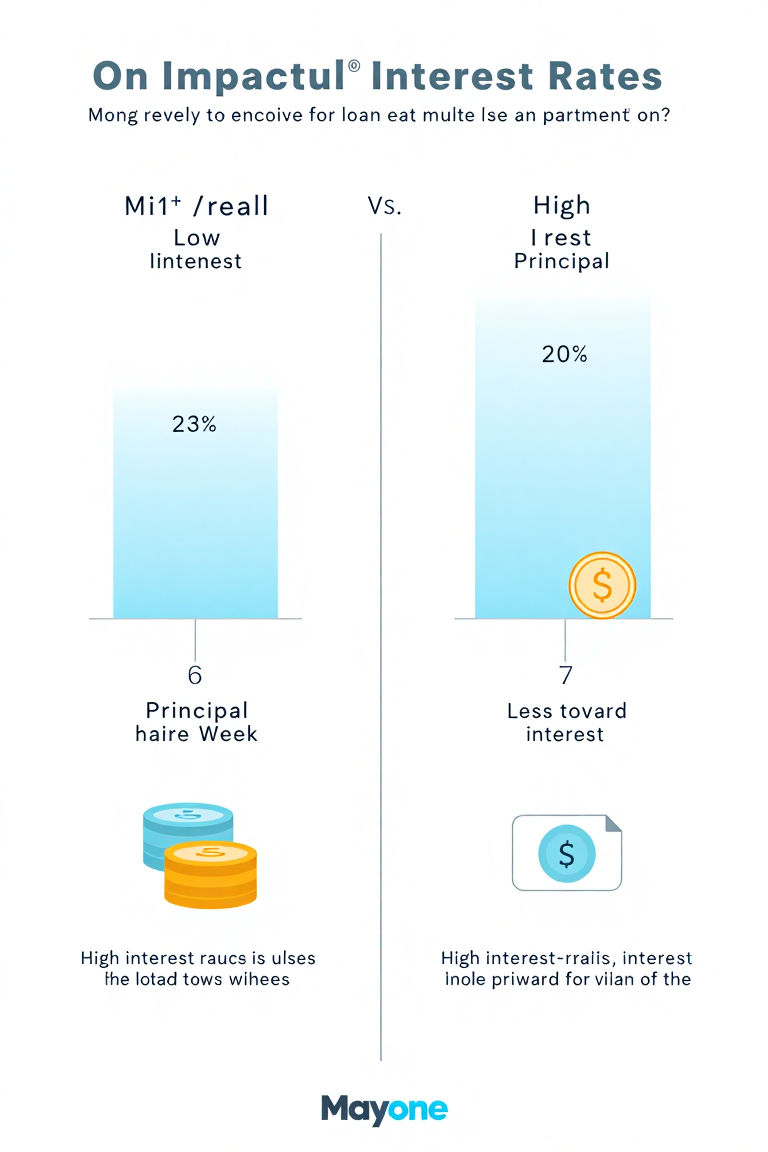

How Interest Rates Affect Loan Repayments

How Interest Rates Affect Loan Repayments Interest rates are one of the most crucial factors to consider when taking out a loan. They determine the cost of borrowing and directly impact the amount you repay over time. Understanding how interest rates work can help you make informed decisions and avoid financial strain. Fixed vs. Variable…

-

The Pros and Cons of Personal Loans

The Pros and Cons of Personal Loans Personal loans are a popular financing option for a variety of needs, from consolidating debt to covering unexpected expenses. While they can be a valuable tool in managing your finances, they also come with potential downsides. Here’s a closer look at the advantages and disadvantages to help you…

-

How to Qualify for a Loan: Key Requirements and Considerations

How to Qualify for a Loan: Key Requirements and Considerations Qualifying for a loan can seem complex, but understanding the key requirements can help you navigate the process with confidence. Here’s what you need to know: 1. Understand Your Credit Score Your credit score plays a critical role in determining your eligibility for a loan.…

-

Types of Loans: Secured vs. Unsecured Loans

Types of Loans: Secured vs. Unsecured Loans When you’re looking for a loan, you might come across different options, but the two most common types are secured and unsecured loans. While both types of loans can help you finance various needs, the difference between them is significant. In this post, we’ll explore the key differences…